Drone Insurance 101: Protecting Your Investment

In the ever-evolving world of technology, drones have become indispensable tools for photographers, hobbyists, and professionals alike. These unmanned aerial vehicles offer a unique perspective and have become a significant investment for many. However, as with any valuable asset, protecting your drone is crucial. In this guide, we'll explore the ins and outs of drone insurance to help you make an informed decision and safeguard your investment.

Understanding the Importance of Drone Insurance

Drones, while offering incredible capabilities, are not immune to accidents or unforeseen circumstances. Whether you use your drone for aerial photography, surveying landscapes, or even recreational flying, accidents can happen. Drone insurance provides a safety net, offering financial protection against damages, accidents, and potential liabilities.

Types of Drone Insurance Coverage

1.Liability Coverage: One of the fundamental aspects of drone insurance is liability coverage. This protects you in case your drone causes damage to property or injures someone. Accidents can happen, and liability coverage ensures that you are financially covered for legal expenses, medical bills, and property damage.

2.Hull Coverage: Hull coverage is akin to comprehensive coverage for your car. It covers damages to your drone itself, whether it's due to a crash, equipment failure, or even theft. Considering the cost of drones, hull coverage is essential for safeguarding your investment.

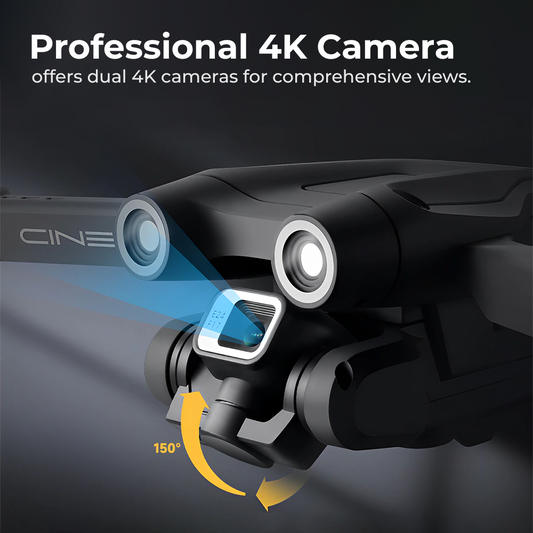

3.Payload Coverage: If your drone is equipped with specialised equipment or cameras, payload coverage ensures that these valuable additions are also protected. This is particularly important for professionals using drones for specific tasks like aerial photography, surveying, or mapping.

4.Personal Injury Coverage: In addition to liability coverage, some policies offer personal injury coverage. This protects you in case your drone causes bodily harm to others, providing coverage for medical expenses and potential legal fees.

Factors to Consider When Choosing Drone Insurance

1.Type of Drone Usage: The nature of your drone usage plays a significant role in determining the type and extent of coverage you need. A recreational drone user might have different insurance needs compared to a professional photographer or surveyor.

2.Coverage Limits: When selecting a drone insurance policy, pay close attention to coverage limits. Ensure that the limits align with the potential risks associated with your drone usage. Higher coverage limits may be necessary for commercial drone operations.

3.Geographical Coverage: Some insurance policies may have limitations on where your drone is covered. If you plan to use your drone internationally, make sure your policy provides adequate geographical coverage.

4.Policy Exclusions: Carefully review the policy exclusions to understand situations where coverage may not apply. Common exclusions may include intentional damage, illegal activities, or reckless flying.

5.Deductibles: Consider the deductible amount associated with the policy. A lower deductible means you'll pay less out of pocket in the event of a claim, but it may result in higher premium costs.

Tips for Lowering Drone Insurance Premiums

1.Safety Measures:

Implementing safety measures can significantly impact your insurance premium. Completing a certified drone safety course and adhering to industry best practices can demonstrate your commitment to risk mitigation.

2.Equipment Upgrades:

Upgrading your drone with the latest safety features can make you eligible for discounts. Many insurance providers offer lower premiums for drones equipped with collision-avoidance systems, GPS tracking, and other safety enhancements.

3.Flight Experience:

Insurance providers often consider your flight experience when determining premiums. The more experienced you are as a drone pilot, the lower the perceived risk, potentially leading to lower insurance costs.

4.Bundle Policies: If you already have insurance policies, consider bundling them with your drone insurance. Many providers offer discounts for bundling, which can result in overall cost savings.

5.Shop Around: Don't settle for the first insurance quote you receive. Shop around and compare quotes from different providers. Consider not only the cost but also the coverage offered to ensure it meets your specific needs.

In the fast-paced world of drone technology, investing in a comprehensive insurance policy is a prudent step to protect your valuable asset. Whether you fly your drone for leisure or as part of your profession, understanding the nuances of drone insurance is crucial. By selecting the right coverage, adhering to safety measures, and considering cost-saving strategies, you can enjoy the full potential of your drone while safeguarding your investment. Remember, accidents can happen, but with the right insurance coverage, you can fly with confidence and peace of mind.

Explore a variety of drones at our online drone store.

Happy Flying!