Drones for Insurance Inspections: Quick Assessments

The use of drones in the insurance industry is transforming how inspections are conducted. From streamlining claim processes to improving property evaluations, drones provide unparalleled efficiency and accuracy. This guide explores how drones are reshaping insurance inspections, targeting keywords such as drones for insurance inspections, "quick assessments," and "drone technology for insurance claims."

1. What Are Drones for Insurance Inspection?

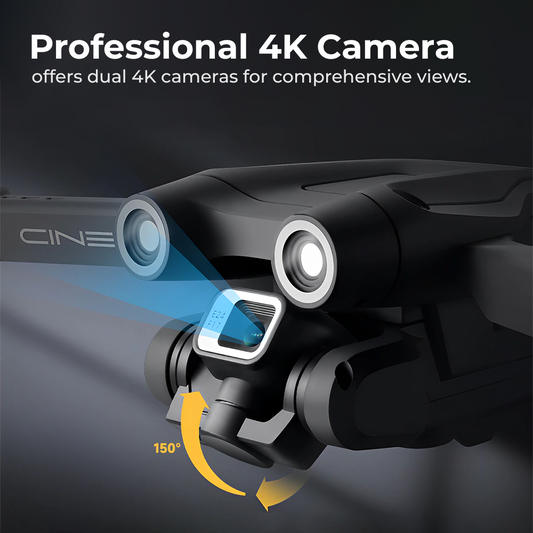

Drones, also known as unmanned aerial vehicles (UAVs), are increasingly used in the insurance industry to perform inspections. Equipped with advanced cameras and sensors, these devices can capture detailed images and data from hard-to-reach areas, such as rooftops or disaster-stricken properties.

Drones streamline the inspection process by reducing the time and cost of manual evaluations. For instance, instead of dispatching a team to inspect a damaged roof, a drone can perform the task in minutes. This not only speeds up claim processing but also minimizes safety risks for inspectors.

Insurance companies leveraging drones benefit from more precise assessments, reducing the likelihood of errors and disputes. As a result, Drones for Insurance Inspections.

2. Benefits of Using Drones in Insurance Inspections

The integration of drones offers numerous advantages, such as:

- Speed: Drones conduct inspections in a fraction of the time compared to traditional methods.

- Safety: Inspecting hazardous areas, like unstable buildings, is safer when done remotely with a drone.

- Cost-Effectiveness: Using drones reduces labor and equipment expenses.

- Data Accuracy: High-resolution cameras and sensors ensure precise data collection for better assessments.

- Customer Satisfaction: Faster claim processing leads to improved customer experiences.

For instance, during natural disasters, drones help insurers quickly assess damage across multiple properties, enabling quicker payouts to policyholders.

3. How Drones Improve Property Inspections for Insurance

One key application of Drones for Insurance Inspections. From residential roofs to large commercial buildings, drones provide detailed aerial views that would otherwise require ladders, scaffolding, or cranes.

Drones equipped with thermal imaging cameras can detect hidden issues, such as water leaks or structural weaknesses, which might not be visible during a standard inspection. This level of precision ensures insurers can accurately assess repair costs, preventing over- or underestimations.

Moreover, drones are instrumental in post-disaster scenarios. After hurricanes, floods, or wildfires, drones quickly capture the extent of damage, helping insurers prioritize and process claims efficiently.

4. Using Drones for Roof Inspections in Insurance

Roof inspections are one of the most common uses of Drones for Insurance Inspections. Traditional roof inspections are time-consuming and risky, requiring inspectors to climb ladders and navigate steep angles.

Drones eliminate these challenges by providing high-resolution images of roofs within minutes. This approach not only reduces safety risks but also ensures comprehensive coverage of all areas, including hard-to-reach spots.

For insurance claims, this means accurate evaluations of damage caused by events like hailstorms or fallen trees. Powerful Drones can also detect early signs of wear and tear, helping policyholders address issues before they escalate. As a result, drones enhance the overall efficiency of roof inspections.

5. Drone Technology in Insurance Claims Processing

The integration of drone technology into claims processing has revolutionized the insurance industry. Insurers now use drones to gather detailed evidence of damage, which is crucial for fair and accurate claim settlements.

For instance, Drones for Insurance Inspections can document the aftermath of accidents, fires, or natural disasters with high-definition visuals and 3D mapping. This data allows adjusters to assess the situation remotely, expediting the claims process.

By using drones, insurers also reduce the potential for fraudulent claims. With clear aerial imagery and metadata, they can verify the authenticity of reported damages, ensuring payouts are made only for legitimate claims.

6. Legal and Ethical Considerations for Insurance Drone Use

While drones offer significant advantages, their use in the insurance sector must comply with legal and ethical guidelines. Key considerations include:

- Regulations: Operators must adhere to local aviation rules, such as FAA regulations in the U.S., which govern drone flight altitudes and areas.

- Privacy Concerns: Insurers must ensure drones do not infringe on the privacy of homeowners or neighboring properties.

- Data Security: Sensitive information collected by drones should be securely stored and protected from breaches.

By addressing these issues, insurers can leverage Drones tools with price for Insurance Inspections responsibly, maximizing benefits while minimizing risks.

7. Case Studies: Real-World Applications of Insurance Drones

Case Study 1: Post-Hurricane Assessments

After Hurricane Ian in 2022, drones were deployed to assess widespread damage in Florida. Insurers used aerial imagery to evaluate roof damage, fallen trees, and flood-affected areas. This allowed for quicker claim approvals, providing much-needed relief to policyholders.

Case Study 2: Industrial Inspections

A leading insurer used drones to inspect a fire-damaged factory. The Drones for Insurance Inspections captured detailed footage of structural damage, enabling engineers to create accurate repair estimates. This saved time and reduced costs compared to traditional inspection methods.

These examples highlight the versatility of drones in insurance operations, from residential to industrial applications.

8. The Future of Drones in the Insurance Industry

As technology advances in drones are expected to play an even greater role in the insurance industry. Innovations such as AI-powered analytics and autonomous flight capabilities will further enhance their efficiency.

For instance, AI can analyze drone-captured data in real-time, identifying damage patterns and predicting repair costs. Additionally, autonomous drones will allow insurers to perform inspections without requiring manual operation, reducing the need for skilled pilots.

The adoption of drones is likely to expand beyond inspections, with potential applications in risk assessment and fraud detection. As a result, drones will continue to be a game-changer for insurance companies seeking to improve their operations.

Drones for Insurance Inspections

Drones are revolutionizing insurance inspections, offering quick, accurate, and cost-effective assessments. From property evaluations to claim processing, these devices enhance efficiency across the board. By addressing legal considerations and leveraging advanced technology, insurers can unlock the full potential of drones, benefiting both their operations and their policyholders.

As drones become an integral part of the insurance landscape, companies that adopt this technology will gain a competitive edge, delivering faster and more reliable services in an increasingly demanding market.

Find your perfect drone at our online drone store, where top-tier technology meets expert support. Transform your aerial projects with our premium selection.